What is your credit score and why does it matter?

Do you know your credit score? Many people don’t. Those three numbers between 300 and 850 can make a huge difference in how much interest you are charged for loans and can impact your ability to buy a car, a house, and even get insurance. (Don’t worry. Maryland Auto doesn’t use credit scores to determine eligibility or your premium rate.)

Your credit determines whether you’ll be approved for a loan and what interest rate you will be charged on that loan. The lower your credit score, the higher the interest charges you will pay to the lender. Higher interest means you pay back more, overall, on the loan.

Insurance companies may charge higher premiums for customers who have lower credit scores. In addition, although utility services, such as gas, electricity, or water, can’t be denied based on credit, providers may require large security payments from customers with a low credit score before they will provide services.

Related: How Much Does Credit Score Affect Auto Insurance Rates (Experian.com)

Credit rating companies such as Equifax, Experian, and TransUnion, use several criteria to calculate your credit score. Factors like payment history, late payments, collections referrals, the number of new lines of credit you’ve opened, and what percentage of your credit limit you are currently using can determine whether your score goes up or down.

What makes a “good” credit score?

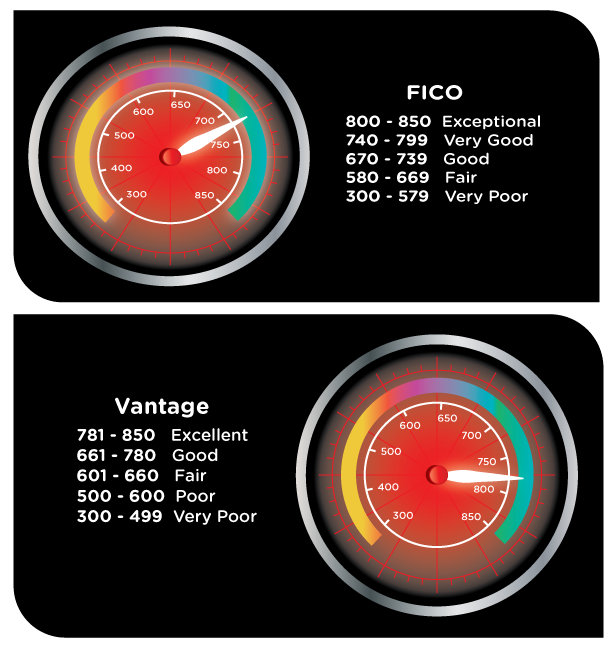

Each credit rating service has their own scale to determine what good credit looks like. However, on the 300-to-850 scale, a score of at least 670 (for FICO®) and 700 (for VantageScore) will typically qualify as having good credit.